Fantasy Cricket Ad Revenue Model explained: Discover how Dream11 & My11Circle earn crores from ads, prizes, and free contests after the 2025 gaming ban.

Introduction: The Transformation of Fantasy Cricket

Fantasy cricket is no longer just a hobby—it has grown into a multi-billion-rupee digital economy. In India, fantasy sports apps transformed how fans engage with cricket, peaking during the IPL seasons. But in 2025, everything changed.

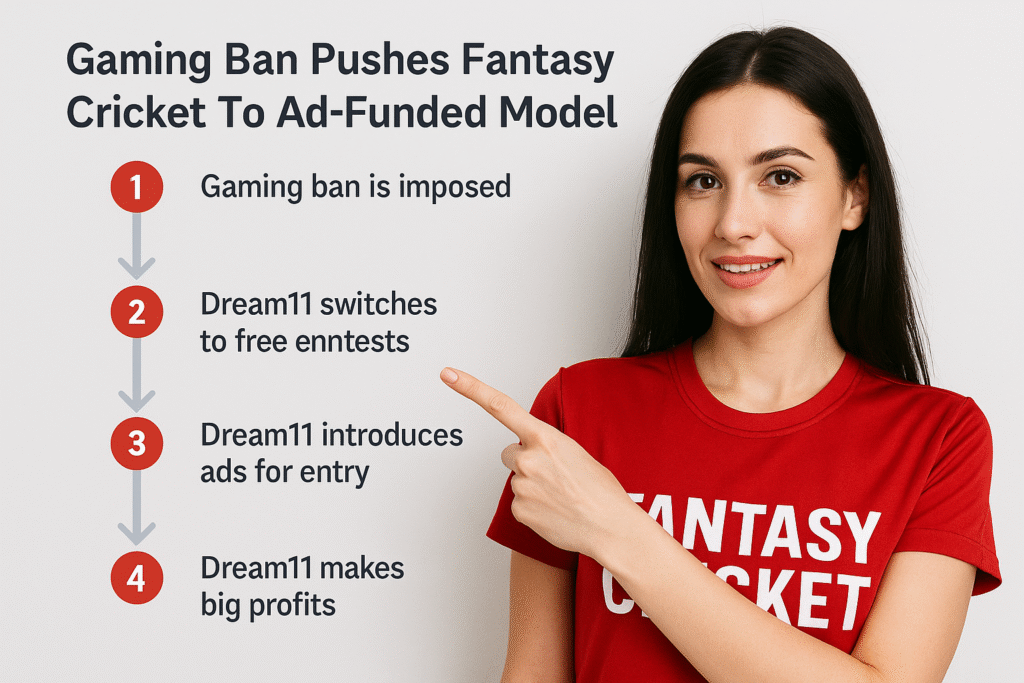

The Promotion and Regulation of Online Gaming Act banned real-money fantasy contests, threatening to end the business model that apps like Dream11 and My11Circle depended on. Many feared layoffs, shrinking contests, and the collapse of fantasy cricket.

Instead, something remarkable happened: these platforms pivoted. They introduced free contests with ad-based entries, replacing entry fees with ad impressions. Surprisingly, this shift boosted revenues instead of shrinking them.

In this guide, we’ll explore the Fantasy Cricket Ad Revenue Model in detail, covering contest structures, prize pools, revenues, risks, and strategies for the future.

Table of Contents

In this ultimate guide, we’ll explore the Fantasy Cricket Ad Revenue Model, analyze contest structures, calculate annual profits, assess long-term sustainability, and uncover strategies for the future.

The Rise of Fantasy Cricket After the Gaming Ban

Rise of Fantasy Cricket After the Gaming Ban Explained: The 2025 ban outlawed cash-entry fantasy contests. Critics argued these games were too close to gambling, while platforms insisted they were skill-based. Either way, the industry needed a reset.

Key changes after the ban:

- Free contests replaced paid ones.

- Ads became the new entry fee.

- Profits grew, thanks to India’s massive digital population and high ad demand.

Dream11, with over 850 employees, and My11Circle, with 300+ staff, didn’t cut jobs. Instead, they expanded their focus on advertising partnerships, ensuring the new model was sustainable.Dream11 (850 employees) and My11Circle (300+ staff) kept manpower intact, proving the ad model was sustainable.

How the Ad-Entry Model Works in Fantasy Cricket

The ad-entry model has proven to be both simple and powerful: users watch a short video ad, the platform earns from CPM impressions, and contests remain free to join. This loop sustains high engagement even without cash entry fees.

👉 But ads may not be the only future path. A subscription-driven model could ensure consistent revenue, stronger user loyalty, and bigger prize pools. To see how that works, check our in-depth guide:

Dream11 Subscription Model: The Bright Future Business Model for Fantasy Sports

The ad-entry model is straightforward:

- User selects a contest → To join, they must watch a video ad.

- Ad generates revenue → Platforms earn via CPM (cost per 1000 ad views).

- Contest proceeds → Winners receive prizes.

- Retention loop → Non-winners still return, keeping ad impressions flowing.

Typical CPM rates in India range from ₹60–₹120 for rewarded ads. With millions of players and multiple teams per user, the ad-entry system generates massive revenue per match.

Contest Structures: Dream11 contests vs My11Circle contests

| Platform | Contest Type | Spots (approx) | Ad Views | Prize Pool | Revenue @ ₹100 CPM |

|---|---|---|---|---|---|

| Dream11 | Mega Contest | 2 crore | 20M | ₹50L–₹1Cr | ₹20 crore+ |

| Dream11 | Fun Contests | 2–3 × 3 lakh | 0.6–0.9M | Nil | ₹0.6–0.9 crore |

| My11Circle | Contest 1 | 40 lakh | 4M | ~₹10L | ₹4 crore |

| My11Circle | Contest 2 | 20 lakh | 2M | ~₹5L | ₹2 crore |

| My11Circle | Contest 3 | 9.8 lakh | 1M | ~₹3L | ₹1 crore |

| My11Circle | Contest 4 | 5.5 lakh | 0.55M | ~₹2L | ₹0.55 crore |

👉 Dream11 leads with mega 2 crore-entry contests.

👉 My11Circle thrives on multiple mid-sized contests with diversified prize structures.

Dream11 currently dominates with 2-crore entry mega contests, while My11Circle spreads users across multiple mid-sized contests. Both models generate thousands of crores annually from ad views.

👉 But the real game-changer could be “Free Grand Leagues” — mass-participation contests supported by ads, brand sponsorships, and broadcasters. Dive into the full analysis here:

Dream11 Future Business Model: Free Entry Grand Leagues! Powered by Ads, Passes, Sponsorships, and Broadcaster Support

Annual Fantasy Cricket Revenue Vs OTT streaming platforms revenue

Fantasy cricket has transformed into a billion-dollar digital industry, with ad-based models driving enormous revenues. When you calculate earnings on a per-match basis and scale it across an entire calendar year, the numbers become staggering.

- Dream11: With ~₹21 crore ad revenue per match × 750 matches annually = ₹15,750 crore/year.

- My11Circle: At ~₹8 crore ad revenue per match × 750 matches annually = ₹6,000 crore/year.

- Industry Total: Together, these platforms generate around ₹22,000 crore (~$2.7B) annually.

To put this in perspective, fantasy cricket rivals — and in some cases surpasses — India’s leading OTT streaming platforms in terms of annual ad revenue. The reason is simple: fantasy contests engage users daily across multiple sports formats, generating repeat ad impressions and unmatched user retention.

Deducting Prize Payouts

- Dream11: Spends ~₹600 crore/year on prizes → Net Profit = ₹15,000 crore.

- My11Circle: Spends ~₹200 crore/year → Net Profit = ₹5,800 crore.

👉 Margins remain above 95%, proving the ad model is highly efficient.

Scenario Matrix: High vs Low CPM × Prize Models

| Platform | Model | High CPM (₹100) | Low CPM (₹60) |

|---|---|---|---|

| Dream11 | Few Winners | ₹15,000 cr/yr | ₹8,700 cr/yr |

| Dream11 | 50k Winners | ₹13,125 cr/yr | ₹6,825 cr/yr |

| My11Circle | Few Winners | ₹5,625 cr/yr | ₹3,045 cr/yr |

| My11Circle | 50k Winners | ₹4,650 cr/yr | ₹2,070 cr/yr |

👉 Even in a low CPM market, Dream11 thrives. My11Circle faces tighter margins.

Our data shows that even if ad rates drop, Dream11 remains highly profitable. My11Circle too earns big but with thinner margins.

👉 Yet the most exciting question is: what happens beyond CPM in India? When ICC tournaments and global leagues are factored in, projections skyrocket. We’ve mapped it out in this report:

Dream11 Future Business Model 2025 to 2028: Exciting Global Revenue Projections from ICC Events & Leagues

User Fatigue: The Hidden Risk

- Dream11 win rate: 0.0025% (500 winners in 20M).

- My11Circle: 0.05%.

Such low chances risk disengagement. Over time, fewer users = fewer ad views = revenue decline.

Alternative Prize Models

1. 50,000 Winners Model

- Win chance improves to 0.25%–0.65%.

- Prize costs rise 3–4×.

- Profits fall ~15% but retention improves significantly.

2. Brand-Sponsored Prizes

- Coupons from Amazon, Paytm, boAt, Swiggy reduce direct prize expenses.

3. Hybrid Model

- Big matches → few mega winners for hype.

- Small matches → mass coupon winners for retention.

3-Year Projections (2025–2027)

| Platform | Current Model (Few Winners) | Expanded Model (50k Winners) |

|---|---|---|

| Dream11 | ₹45,000 cr profit | ₹39,375 cr profit |

| My11Circle | ₹16,875 cr profit | ₹13,950 cr profit |

Both remain highly profitable, though expanding winners trades margin for loyalty.

Strategic Recommendations

Dream11

- Expand globally (e.g., cricket in UK, Australia).

- Experiment with e-sports fantasy.

- Invest in AI engagement tools (personalized prize offers).

My11Circle

- Rely on brand tie-ups to sponsor prizes.

- Push regional contests for loyalty.

- Build gamified loyalty systems to retain casual users.

Conclusion

Fantasy cricket’s ad revenue model is proof of adaptability. What began as a forced pivot after the 2025 ban is now a powerhouse business model.

Survival depends on user engagement. Without broader prize distribution, fatigue may reduce participation. But with ads, coupons, hybrid rewards, and gamification, fantasy cricket can remain one of India’s most profitable digital sectors.

What is the fantasy cricket ad revenue model?

It’s a system where users watch ads to join free contests, and platforms earn via advertisers (₹60–₹120 CPM).

How much does Dream11 earn per match?

Roughly ₹21 crore in ad revenue per match.

How much does My11Circle earn per match?

Around ₹7–8 crore from ads.

Do these platforms still give cash prizes?

Yes—Dream11 offers ₹50L–₹1Cr pools; My11Circle gives cars, bikes, and gadgets.

What happens if ad rates drop?

Dream11 remains profitable (₹8,000+ cr yearly). My11Circle’s profits shrink more.

Will prizes expand in the future?

Yes—likely via vouchers, coupons, and micro-rewards.

Why don’t they need to cut manpower?

Because profits remain massive versus operating costs (~₹400–450 cr annually).

Is fantasy cricket bigger than OTT in India?

Yes—annual ad revenues rival Hotstar, SonyLIV, and JioCinema.